As I mentioned last month I’ve started a series of monthly financial reviews to track my own progress.

August Monthly Financial Review

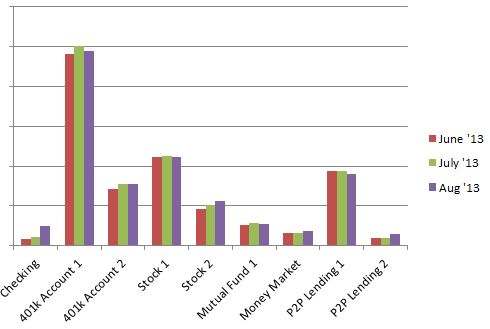

August – Assets +1.87%, Debts 0%

With an upcoming trip to Córdoba, Argentina my single biggest financial goal has been saving cash. In August I was extremely fortunate as I was able to essentially double my cash holdings. I received a quarterly bonus at work and also had my Argentina trip officially approved meaning that several of the expenses that originally came out of my own pocket were reimbursed.

The S&P 500 was down 3.1% in the month of August, the worst month since May 2012. So I was fairly lucky to add 1.87% to my assets given that most of my investments were down for the month. The cash savings above and my investment in stock 2 (up 11%) helped save the month.

Credit card debt remained at $0.

One of my primary goals for August was to create a budget for life in Córdoba, Argentina. Before I share the budget just a few notes on the current money situation in Argentina.

The official exchange rate as of this post is 1 US Dollar = 5.67 Argentine Pesos. This is a great rate considering that when I first visited the country in 2010, 1 greenback netted you only 4 Argentine Pesos.

However Argentina has a bustling black market for US Dollars. The government here has virtually made it impossible for the people to legally get US Dollars. Wanting to avoid the inflation and the volatility of the peso, the Argentine people are willing to pay a premium to land the dollars which they refer as the Dólar Blue.

All of this is extremely advantageous for someone earning dollars since it adds another 32% or so on my money. As a result in my budget I have both the normal exchange rate (5.67) and the Blue Dollar rate (8.28).

This budget should allow me a comfortable lifestyle in Argentina and is still well below my monthly expenses living in San Francisco. I’ll keep this blog updated with whether or not this budget was accurate. If anyone living in Argentina has feedback on expenses, I’d love to hear them.

Goals for September –

- Asset growth of 1%